Is Alcoa Inc A Service Merchandise Or Manufacturing Business

Edifice Blocks of Managerial Accounting

8 Distinguish between Merchandising, Manufacturing, and Service Organizations

Well-nigh businesses can be classified into one or more of these three categories: manufacturing, merchandising, or service. Stated in broad terms, manufacturing firms typically produce a product that is then sold to a merchandising entity (a retailer) For case, Proctor and Gamble produces a multifariousness of shampoos that it sells to retailers, such as Walmart, Target, or Walgreens. A service entity provides a service such as accounting or legal services or cable television and internet connections.

Some companies combine aspects of two or all three of these categories inside a single business. If it chooses, the same company tin can both produce and market place its products directly to consumers. For example, Nike produces products that it directly sells to consumers and products that information technology sells to retailers. An example of a company that fits all three categories is Apple tree, which produces phones, sells them directly to consumers, and also provides services, such as extended warranties.

Regardless of whether a business is a manufacturer of products, a retailer selling to the customer, a service provider, or some combination , all businesses set up goals and take strategic plans that guide their operations. Strategic plans look very unlike from one company to another. For example, a retailer such as Walmart may accept a strategic plan that focuses on increasing aforementioned store sales. Facebook'southward strategic plan may focus on increasing subscribers and attracting new advertisers. An accounting firm may have long-term goals to open offices in neighboring cities in order to serve more than clients. Although the goals differ, the process all companies use to achieve their goals is the aforementioned. First, they must develop a plan for how they will achieve the goal, and so management will gather, analyze, and use information regarding costs to brand decisions, implement plans, and achieve goals.

(Effigy) lists examples of these costs. Some of these are similar across dissimilar types of businesses; others are unique to a detail business.

| Costs | |

|---|---|

| Type of Business | Costs Incurred |

| Manufacturing Business |

|

| Merchandising Business concern |

|

| Service Business |

|

Knowing the basic characteristics of each cost category is important to understanding how businesses mensurate, allocate, and control costs.

Merchandising Organizations

A merchandising firm is one of the about common types of businesses. A merchandising business firm is a business that purchases finished products and resells them to consumers. Consider your local grocery shop or retail clothing store. Both of these are merchandising firms. Often, merchandising firms are referred to equally resellers or retailers since they are in the business of reselling a product to the consumer at a profit.

Recall virtually purchasing toothpaste from your local drug shop. The drug store purchases tens of thousands of tubes of toothpaste from a wholesale benefactor or manufacturer in order to get a better per-tube cost. Then, they add their mark-up (or turn a profit margin) to the toothpaste and offer it for sale to you. The drug store did not manufacture the toothpaste; instead, they are reselling a toothpaste that they purchased. Virtually all of your daily purchases are fabricated from merchandising firms such every bit Walmart, Target, Macy'southward, Walgreens, and AutoZone.

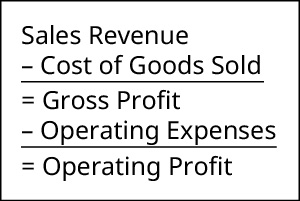

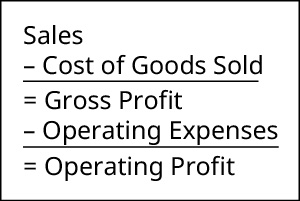

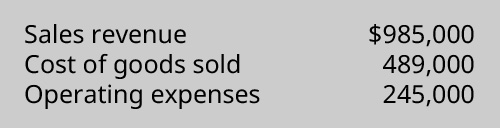

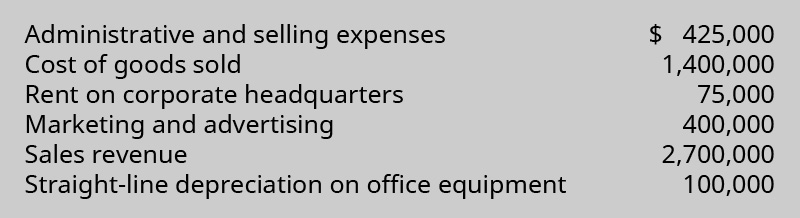

Merchandising firms account for their costs in a unlike way from other types of business organizations. To understand merchandising costs, (Effigy) shows a simplified income argument for a merchandising firm:

Simplified Income Statement for a Merchandising House. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA 4.0 license)

This simplified income statement demonstrates how merchandising firms account for their sales cycle or process. Sales acquirement is the income generated from the sale of finished goods to consumers rather than from the manufacture of goods or provision of services. Since a merchandising house has to purchase goods for resale, they account for this cost as cost of goods sold—what it price them to learn the goods that are and so sold to the client. The difference betwixt what the drug store paid for the toothpaste and the revenue generated past selling the toothpaste to consumers is their gross profit. Even so, in social club to generate sales acquirement, merchandising firms incur expenses related to the procedure of operating their business organization and selling the trade. These costs are chosen operating expenses, and the business concern must deduct them from the gross profit to make up one's mind the operating profit. (Notation that while the terms "operating turn a profit" and "operating income" are ofttimes used interchangeably, in real-world interactions you lot should confirm exactly what the user means in using those terms.) Operating expenses incurred by a merchandising firm include insurance, marketing, administrative salaries, and rent.

Shopping Mall. Merchandising firms must identify and manage their costs to remain competitive and attract customers to their concern. (credit: "stairs shopping mall" by "jarmoluk"/Pixabay, CC0)

Balancing Revenue and Expenses

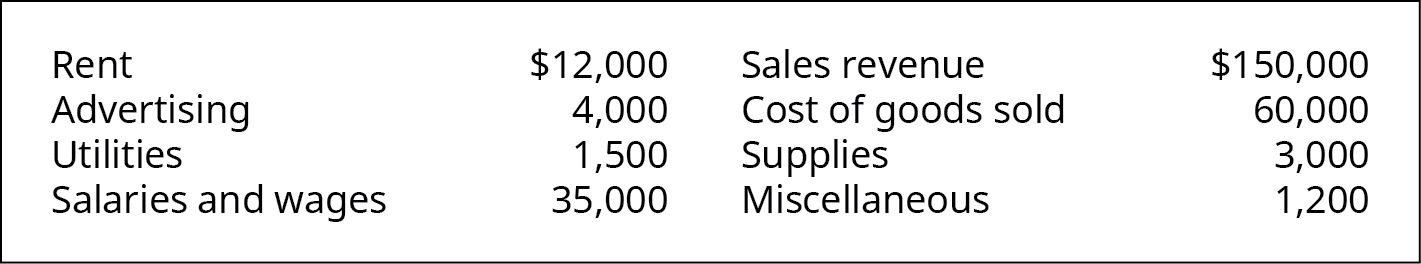

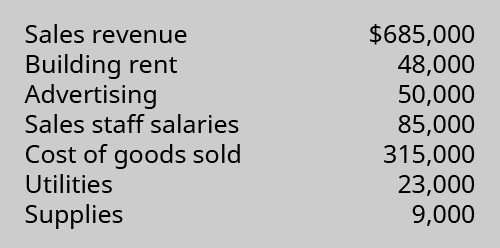

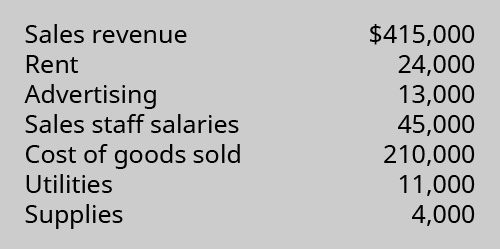

Plum Crazy is a small bazaar selling the latest in mode trends. They purchase wearable and fashion accessories from several distributors and manufacturers for resale. In 2017, they reported these revenue and expenses:

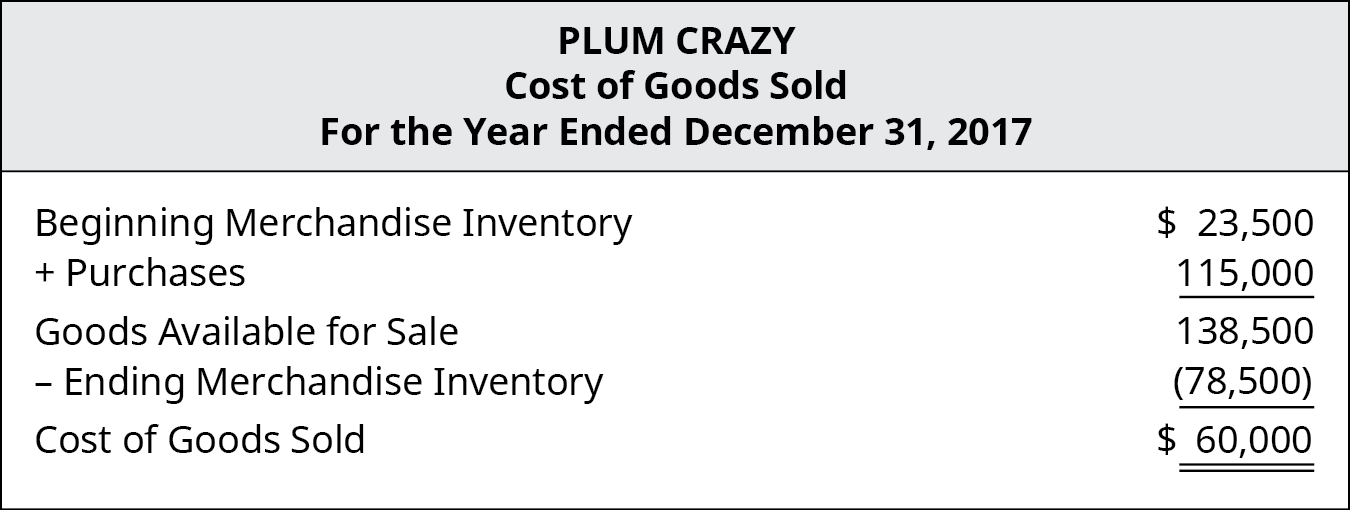

Before examining the income statement, let's look at Cost of Goods Sold in more than detail. Merchandising companies have to account for inventory, a topic covered in Inventory. As y'all think, merchandising companies carry inventory from ane period to another. When they set their income statement, a crucial stride is identifying the actual toll of goods that were sold for the period. For Plum Crazy, their Toll of Goods Sold was calculated every bit shown in (Figure).

Plum Crazy's Cost of Appurtenances Sold Statement. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA iv.0 license)

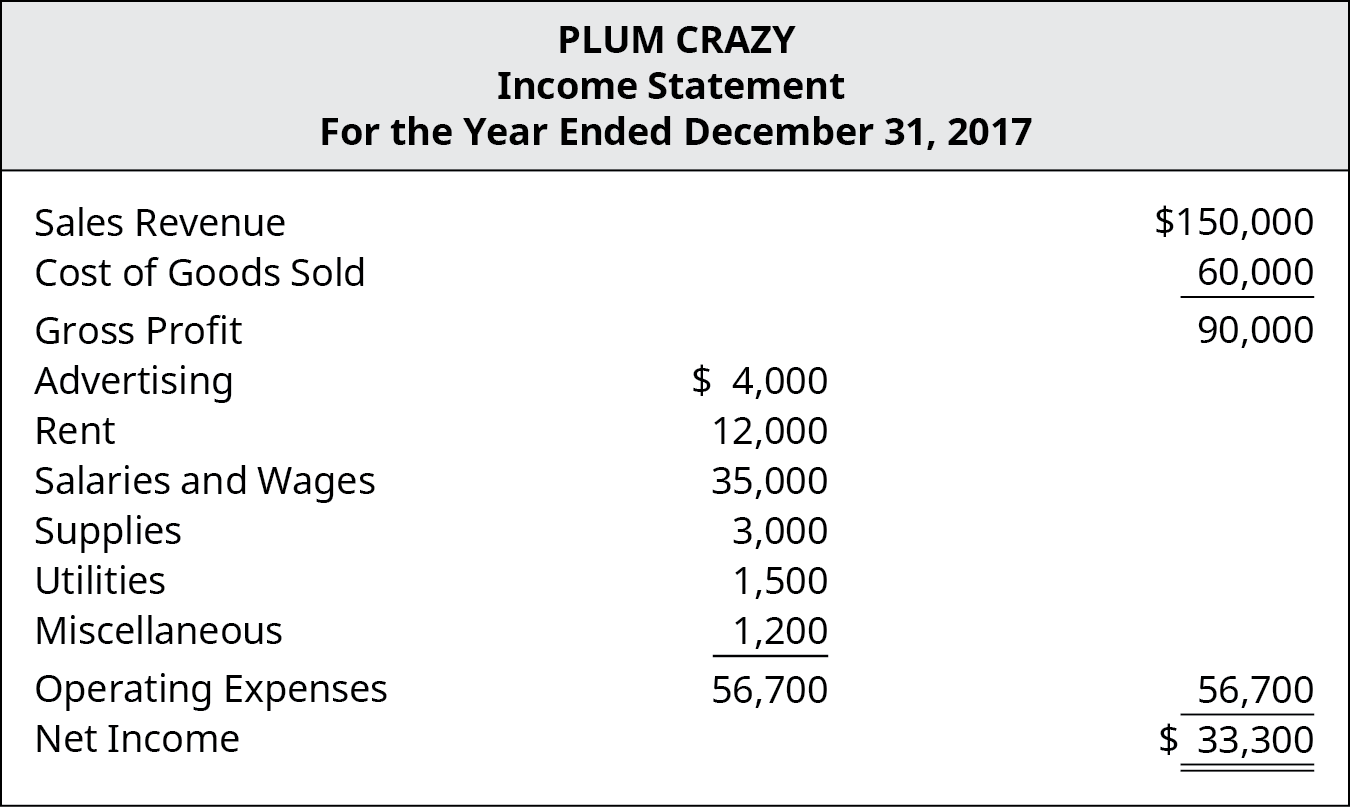

Once the adding of the Cost of Goods Sold has been completed, Plum Crazy can now construct their income statement, which would appear every bit shown in (Figure).

Plum Crazy's Income Statement. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA four.0 license)

Since merchandising firms must pass the cost of goods on to the consumer to earn a profit, they are extremely cost sensitive. Big merchandising businesses like Walmart, Target, and Best Buy manage costs past ownership in majority and negotiating with manufacturers and suppliers to drive the per-unit cost.

Introduction to the Gearhead Outfitters Story

Gearhead Outfitters, founded by Ted Herget in 1997 in Jonesboro, AR, is a retail chain which sells outdoor gear for men, women, and children. The company'due south inventory includes vesture, footwear for hiking and running, camping gear, backpacks, and accessories, by brands such as The N Face, Birkenstock, Wolverine, Yeti, Altra, Mizuno, and Patagonia. Ted fell in love with the outdoor lifestyle while working equally a ski instructor in Colorado and wanted to bring that feeling back habitation to Arkansas. And then, Gearhead was born in a pocket-size downtown location in Jonesboro. The company has had not bad success over the years, expanding to numerous locations in Ted'southward home state, too as Louisiana, Oklahoma, and Missouri.

While Ted knew his industry when starting Gearhead, like many entrepreneurs he faced regulatory and financial issues which were new to him. Several of these issues were related to accounting and the wealth of decision-making information which accounting systems provide.

For example, measuring revenue and expenses, providing data well-nigh cash flow to potential lenders, analyzing whether turn a profit and positive cash flow is sustainable to allow for expansion, and managing inventory levels. Accounting, or the preparation of financial statements (balance canvas, income statement, and statement of cash flows), provides the mechanism for concern owners such as Ted to brand fundamentally sound business decisions.

Manufacturing Organizations

A manufacturing organization is a business that uses parts, components, or raw materials to produce finished goods ((Effigy)). These finished goods are sold either direct to the consumer or to other manufacturing firms that use them as a component part to produce a finished production. For example, Diehard articles car batteries that are sold directly to consumers past retail outlets such equally AutoZone, Costco, and Advance Auto. However, these batteries are besides sold to automobile manufacturers such equally Ford, Chevrolet, or Toyota to be installed in cars during the manufacturing process. Regardless of who the final consumer of the last product is, Diehard must control its costs so that the sale of batteries generates acquirement sufficient to keep the system profitable.

Manufacturing firms apply direct labor to raw materials in order to produce the finished goods purchased from retailers. (credit: "work manufactures" past "dodaning0"/Pixabay, CC0)

Manufacturing firms are more complex organizations than merchandising firms and therefore have a larger variety of costs to control. For instance, a merchandising firm may buy furniture to sell to consumers, whereas a manufacturing house must acquire raw materials such equally lumber, pigment, hardware, glue, and varnish that they transform into furniture. The manufacturer incurs boosted costs, such as directly labor, to convert the raw materials into piece of furniture. Operating a physical plant where the product process takes place also generates costs. Some of these costs are tied straight to product, while others are general expenses necessary to operate the concern. Because the manufacturing process tin can be highly complex, manufacturing firms constantly evaluate their product processes to determine where cost savings are possible.

Cost Command

Controlling costs is an integral part of all managers, merely companies often hire personnel to specifically oversee cost control. As you've learned, decision-making costs is vital in all industries, just at Hilton Hotels, they interpret this into the position of Cost Controller. Here is an excerpt from one of Hilton's recent job postings.

Position Title: Cost Controller

Job Description: "A Cost Controller will work with all Heads of Departments to finer control all products that enter and exit the hotel."1

Job Requirements:

"Every bit Toll Controller, you will piece of work with all Heads of Departments to finer command all products that enter and exit the hotel. Specifically, yous will be responsible for performing the post-obit tasks to the highest standards:

- Review the daily intake of products into the hotel and ensure authentic pricing and quantity of appurtenances received

- Control the stores by ensuring accuracy of inventory and stock control and the pricing of appurtenances received

- Alert relevant parties of irksome-moving appurtenances and appurtenances nearing expiry dates to reduce waste product and change product purchasing to accommodate

- Manage cost reporting on a weekly footing

- Nourish finance meetings, as required

- Maintain good communication and working relationships with all hotel areas

- Deed in accordance with fire, health and safety regulations and follow the correct procedures when required"two

As you can encounter, the individual in this position will interact with others across the organization to find means to control costs for the benefit of the company. Some of the benefits of cost control include:

- Lowering overall company expenses, thereby increasing net income.

- Freeing upwardly fiscal resources for investment in research & evolution of new or improved products, goods, or services

- Providing funding for employee development and preparation, benefits, and bonuses

- Allowing corporate earnings to be used to support humanitarian and charitable causes

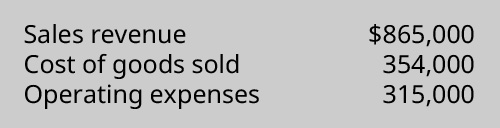

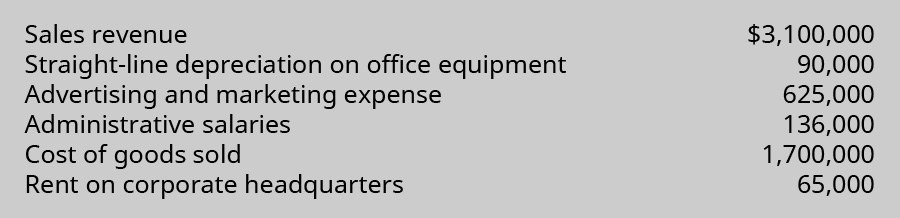

Manufacturing organizations business relationship for costs in a way that is similar to that of merchandising firms. Nonetheless, as you will acquire, at that place is a significant difference in the calculation of cost of goods sold. (Figure) shows a simplification of the income argument for a manufacturing house:

Simplified Income Statement for a Manufacturing Firm. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA iv.0 license)

At get-go it appears that there is no divergence between the income statements of the merchandising firm and the manufacturing firm. Still, the divergence is in how these ii types of firms account for the cost of appurtenances sold. Merchandising firms determine their cost of goods sold past accounting for both existing inventory and new purchases, equally shown in the Plum Crazy example. It is typically easy for merchandising firms to summate their costs considering they know exactly what they paid for their merchandise.

Unlike merchandising firms, manufacturing firms must calculate their price of goods sold based on how much they industry and how much it costs them to industry those goods. This requires manufacturing firms to prepare an additional statement before they can prepare their income argument. This boosted argument is the Cost of Goods Manufactured statement. In one case the cost of goods manufactured is calculated, the cost is and then incorporated into the manufacturing firm's income statement to calculate its price of goods sold.

One affair manufacturing firms must consider in their cost of appurtenances manufactured is that, at any given fourth dimension, they have products at varying levels of production: some are finished and others are all the same process. The cost of goods manufactured statement measures the toll of the goods actually finished during the period, whether or not they were started during that period.

Before examining the typical manufacturing firm's process to track cost of goods manufactured, you lot demand basic definitions of three terms in the schedule of Costs of Appurtenances Manufactured: direct materials, straight labor, and manufacturing overhead. Straight materials are the components used in the production process whose costs can be identified on a per item-produced basis. For example, if you lot are producing cars, the engine would be a directly material item. The direct material cost would be the cost of 1 engine. Direct labor represents production labor costs that can be identified on a per item-produced basis. Referring to the car production case, assume that the engines are placed in the car by individuals rather than by an automated procedure. The direct labor price would be the amount of labor in hours multiplied past the hourly labor cost. Manufacturing overhead generally includes those costs incurred in the production procedure that are not economically feasible to measure as straight textile or direct labor costs. Examples include the department manager'south bacon, the production mill's utilities, or mucilage used to adhere rubber molding in the machine production process. Since there are so many possible costs that can be classified as manufacturing overhead, they tend to exist grouped and and then allocated in a predetermined manner to the production process.

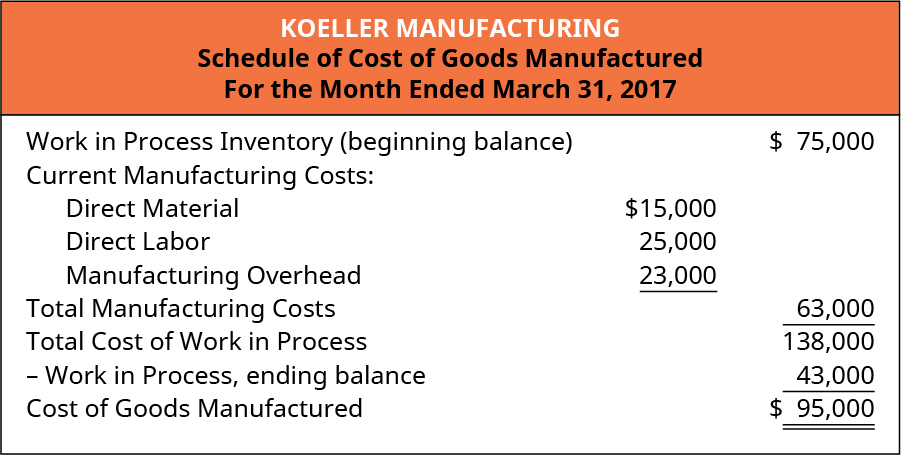

(Figure) is an example of the calculation of the Cost of Goods Manufactured for Koeller Manufacturing. Information technology demonstrates the human relationship between cost of appurtenances manufactured and price of goods in progress and includes the three chief types of manufacturing costs.

Koeller Manufacturing's Cost of Goods Manufactured. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA iv.0 license)

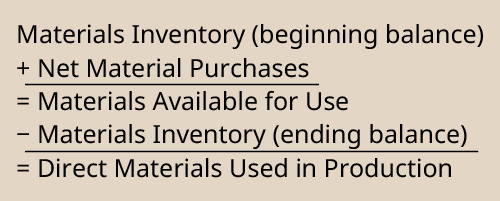

Every bit you lot tin see, the manufacturing firm takes into account its work-in-process (WIP) inventory also as the costs incurred during the current catamenia to finish non only the units that were in the beginning WIP inventory, only besides a portion of any product that was started but non finished during the month. Notice that the current manufacturing costs, or the additional costs incurred during the month, include direct materials, straight labor, and manufacturing overhead. Straight materials are calculated as

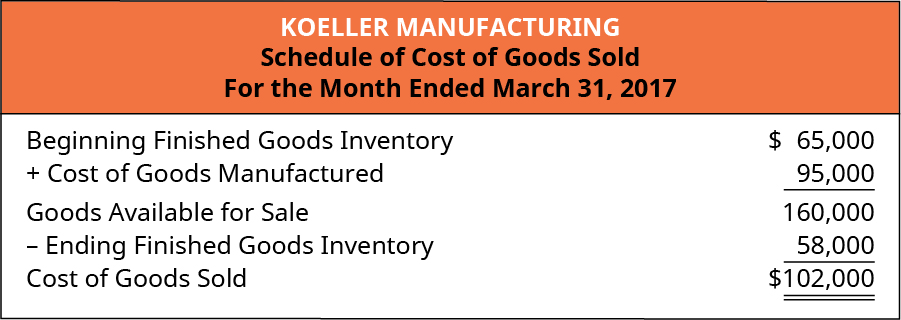

All of these costs are carefully tracked and classified because the price of manufacturing is a vital component of the schedule of cost of appurtenances sold. To proceed with the instance, Koeller Manufacturing calculated that the cost of goods sold was $95,000, which is carried through to the Schedule of Toll of Appurtenances Sold ((Figure)).

Koeller Manufacturing's Price of Goods Sold. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

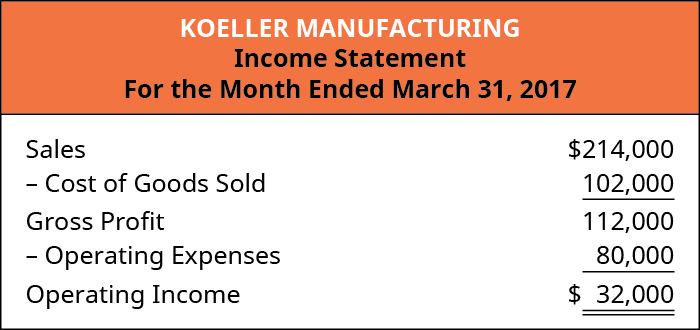

At present when Koeller Manufacturing prepares its income statement, the simplified argument will appear as shown in (Figure).

Koeller Manufacturing's Income Statement. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

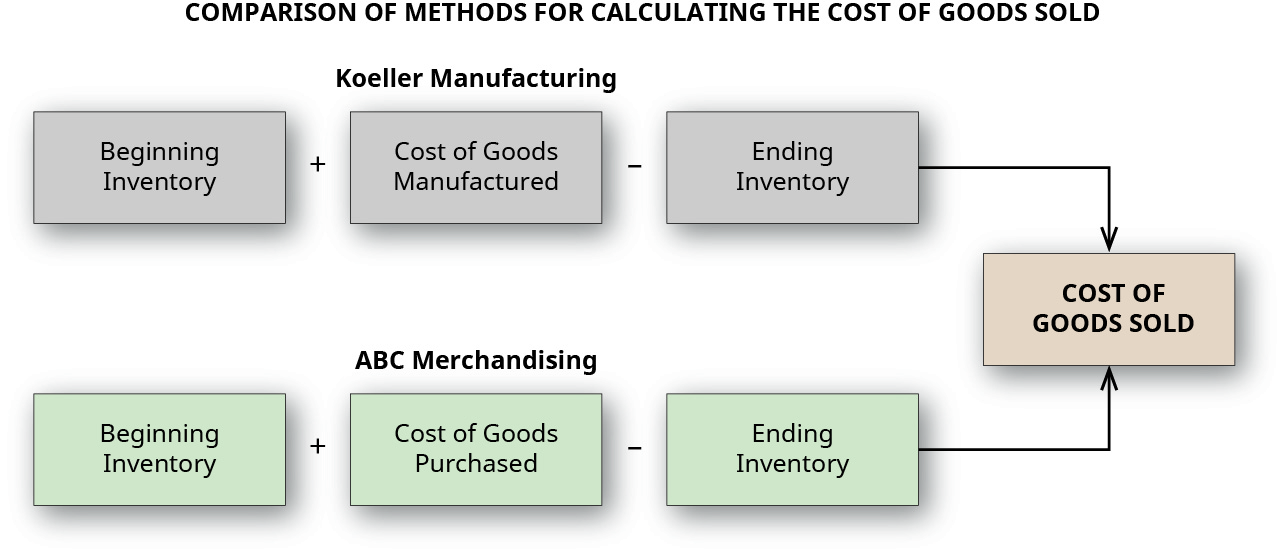

So, even though the income statements for the merchandising firm and the manufacturing firm announced very similar at outset glance, in that location are many more costs to be captured by the manufacturing business firm. (Figure) compares and contrasts the methods merchandising and manufacturing firms use to summate the cost of goods sold in their income statement.

Merchandising firms consider the cost of appurtenances purchased, and manufacturing firms consider the cost of goods manufactured in order to determine the cost of appurtenances sold. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA iv.0 license)

Calculating Cost of Goods Sold in Manufacturing

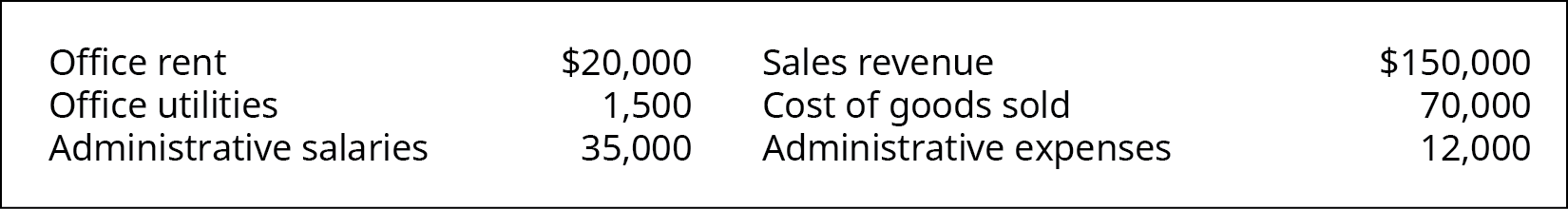

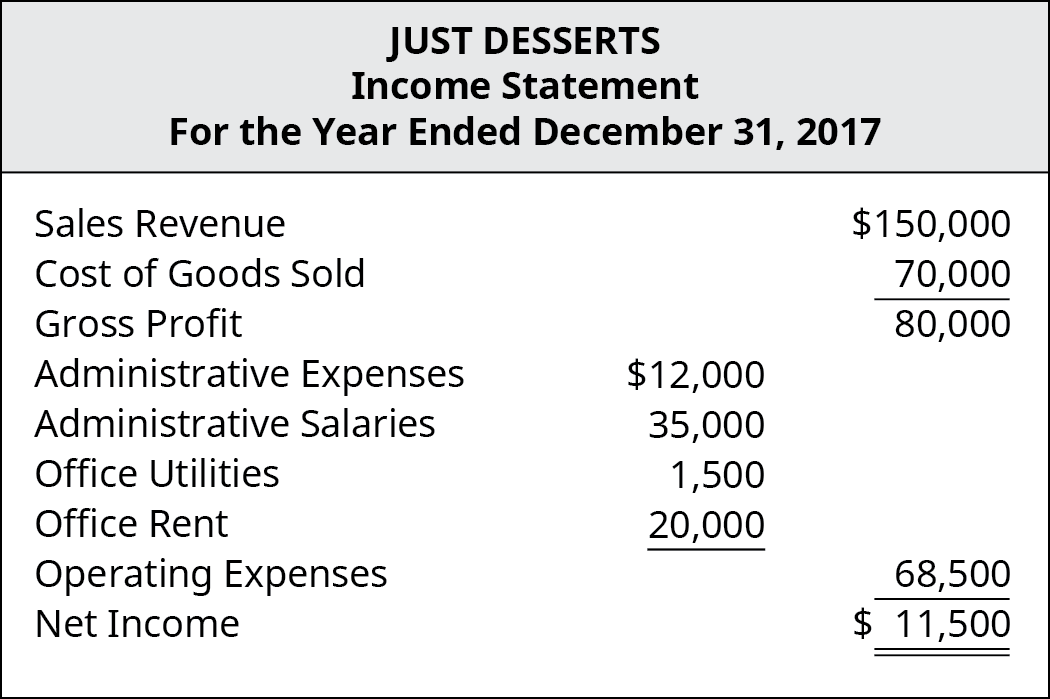

Just Desserts is a bakery that produces and sells cakes and pies to grocery stores for resale. Although they are a small manufacturer, they incur many of the costs of a much larger organization. In 2017, they reported these acquirement and expenses:

Their income statement is shown in (Figure).

Just Desserts' Income Argument. (attribution: Copyright Rice University, OpenStax, nether CC BY-NC-SA 4.0 license)

Yous'll learn more about the menses of manufacturing costs in Identify and Apply Basic Cost Beliefs Patterns. For now, recognize that, dissimilar a merchandising firm, calculating cost of appurtenances sold in manufacturing firms can be a complex job for management.

Service Organizations

A service arrangement is a business that earns revenue past providing intangible products, those that accept no concrete substance. The service industry is a vital sector of the U.S. economy, providing 65% of the U.Southward. private-sector gross domestic product and more than 79% of U.South. individual-sector jobs.3 If tangible products, physical goods that customers tin can handle and run across, are provided by a service organization, they are considered ancillary sources of acquirement. Large service organizations such every bit airlines, insurance companies, and hospitals incur a multifariousness of costs in the provision of their services. Costs such as labor, supplies, equipment, advert, and facility maintenance tin quickly spiral out of command if direction is non conscientious. Therefore, although their cost drivers are sometimes not as complex as those of other types of firms, price identification and control are every chip every bit important in the service industry.

For example, consider the services that a police firm provides its clients. What clients pay for are services such as representation in legal proceedings, contract negotiations, and grooming of wills. Although the true value of these services is non contained in their physical class, they are of value to the client and the source of acquirement to the firm. The managing partners in the business firm must exist as cost conscious as their counterparts in merchandising and manufacturing firms. Accounting for costs in service firms differs from merchandising and manufacturing firms in that they do not purchase or produce appurtenances. For case, consider a medical exercise. Although some services provided are tangible products, such as medications or medical devices, the chief benefits the physicians provide their patients are the intangible services that are comprised of his or her knowledge, experience, and expertise.

Service providers take some costs (or revenue) derived from tangible goods that must be taken into business relationship when pricing their services, but their largest cost categories are more than likely to be administrative and personnel costs rather than product costs.

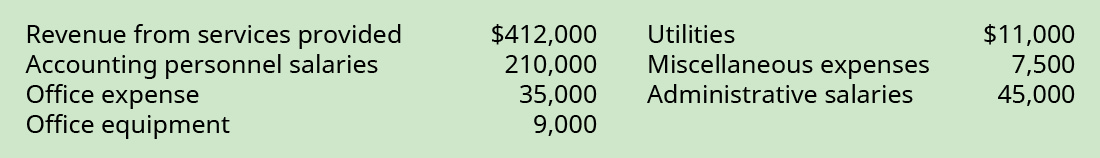

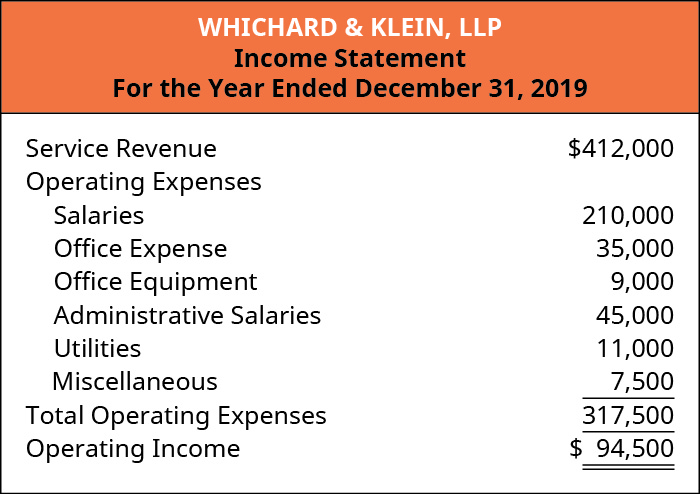

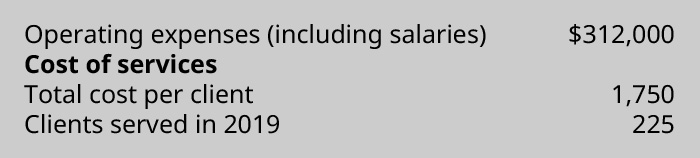

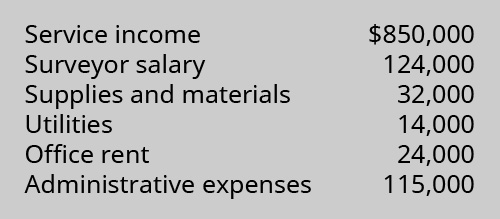

For example, Whichard & Klein, LLP, is a full-service accounting firm with their chief offices in Baltimore, Maryland. With two senior partners and a small staff of accountants and payroll specialists, the majority of the costs they incur are related to personnel. The value of the accounting and payroll services they provide to their clients is intangible in comparison to appurtenances sold by a merchandiser or produced by a manufacturer but has value and is the principal source of revenue for the business firm. At the stop of 2019, Whichard and Klein reported the post-obit revenue and expenses:

Their Income Statement for the menstruation is shown in (Figure).

Whichard & Klein'south Income Statement. (attribution: Copyright Rice University, OpenStax, under CC By-NC-SA 4.0 license)

The bulk of the expenses incurred by Whichard & Klein are in personnel and administrative/function costs, which are very common among businesses that have services equally their principal source of revenue.

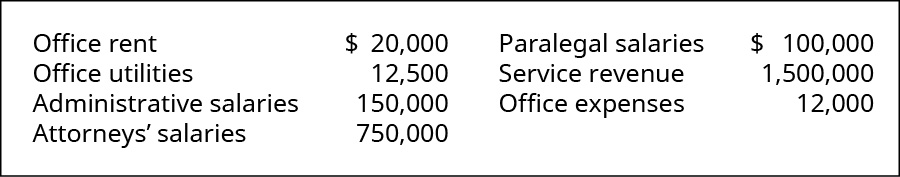

Revenue and Expenses for a Law Role

The revenue and expenses for a law business firm illustrate how the income statement for a service firm differs from that of a merchandising or manufacturing firm.

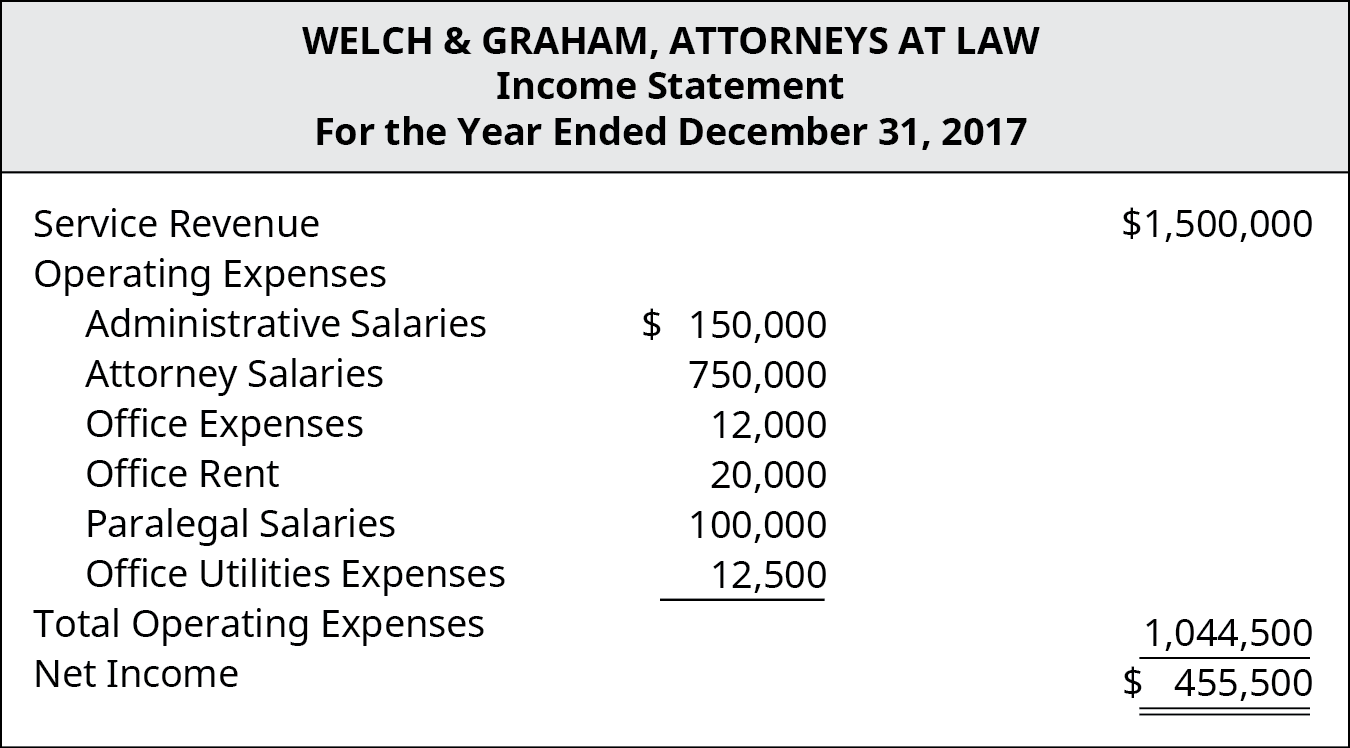

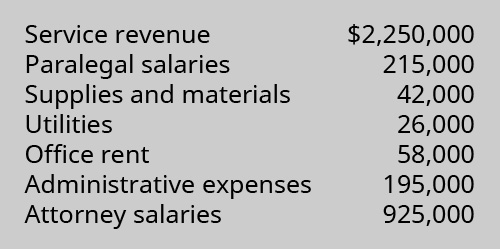

Welch & Graham is a well-established law firm that provides legal services in the areas of criminal constabulary, real estate transactions, and personal injury. The firm employs several attorneys, paralegals, and office support staff. In 2017, they reported the following acquirement and expenses:

Their income statement is shown in (Effigy).

Welch & Graham's Income Statement. (attribution: Copyright Rice Academy, OpenStax, under CC By-NC-SA 4.0 license)

As yous tin see, the majority of the costs incurred by the law firm are personnel related. They may also incur costs from equipment and materials such computer networks, telephone and switchboard equipment, rent, insurance, and law library materials necessary to support the practice, just these costs represent a much smaller percentage of total cost than the administrative and personnel costs.

Expanding a Business

Margo is the owner of a small retail business that sells gifts and home decorating accessories. Her business is well established, and she is at present considering taking over additional retail space to expand her business to include gourmet foods and souvenir baskets. Based on customer feedback, she is confident that there is a demand for these items, but she is unsure how big that demand really is. Expanding her business this mode will require that she incur non only new costs just besides increases in existing costs.

Margo has asked for your help in identifying the impact of her conclusion to expand in terms of her costs. When discussing these cost increases, be sure to specifically place those costs that are direct tied to her products and that would be considered overhead expenses.

Primal Concepts and Summary

- Merchandising, manufacturing, and service organizations differ in what they provide to consumers; nonetheless, all three types of firms must control costs in guild to remain profitable. The type of costs they incur is primarily determined by the product/good, or service they provide.

- As the type of organization differs, then does the way they account for costs. Some of these differences are reflected in the income statement.

(Figure)Which of the post-obit is the principal source of revenue for a service business?

- the production of products from raw materials

- the buy and resale of finished products

- providing intangible goods and services

- the sale of raw materials to manufacturing firms

(Figure)Which of the following is the main source of revenue for a merchandising business?

- the product of products from raw materials

- the purchase and resale of finished products

- the provision of intangible appurtenances and services

- the sale of raw materials to manufacturing firms

(Figure)Which of the following is the primary source of revenue for a manufacturing business?

- the production of products from raw materials

- the buy and resale of finished products

- the provision of intangible goods and services

- both the provision of services and the sale of finished appurtenances

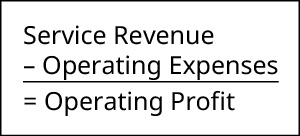

(Figure)Which of the following represents the components of the income statement for a service business?

- Sales Acquirement – Cost of Goods Sold = gross profit

- Service Revenue – Operating Expenses = operating income

- Sales Revenue – Cost of Goods Manufactured = gross profit

- Service Revenue – Toll of Appurtenances Purchased = gross turn a profit

(Effigy)Which of the following represents the components of the income argument for a manufacturing business?

- Sales Revenue – Cost of Appurtenances Sold = gross turn a profit

- Service Revenue – Operating Expenses = gross profit

- Service Revenue – Toll of Goods Manufactured = gross turn a profit

- Sales Revenue – Cost of Goods Manufactured = gross profit

(Effigy)Which of the following represents the components of the income argument for a merchandising business?

- Sales Revenue – Toll of Appurtenances Sold = gross profit

- Service Revenue – Operating Expenses = gross profit

- Sales Revenue – Price of Goods Manufactured = gross profit

- Service Revenue – Cost of Appurtenances Purchased = gross profit

(Figure)Identify the three chief classifications of businesses and explicate the differences among the three.

Answers volition vary but should include merchandising, service, and manufacturing businesses.

(Figure)Explain how the income statement of a manufacturing company differs from the income statement of a merchandising company.

(Figure)Walsh & Coggins, a professional accounting firm, collects price data about the services they provide to their clients. Depict the types of cost data they would collect and explain the importance of analyzing this cost data.

Answers volition vary but should include a discussion of operating costs such every bit salaries and wages, advertisement, rent, and office expenses.

(Effigy)Lizzy'due south is a retail clothing store, specializing in formal wearable for weddings. They buy their wear for resale from specialty distributors and manufacturers. Recently the owners of Lizzy'south have noted an increased interest in costume jewelry and fashion accessories among their clientele. If the owners of Lizzy'southward decide to aggrandize their business to include these products, what cost information would they need to collect and analyze prior to expanding the concern?

(Figure)Magio Company manufactures kitchen equipment used in hospitals. They distribute their products directly to the customer and, for the year ending 2019, they reported the following revenues and expenses. Employ this information to construct an income statement for the year 2019.

(Figure)Park and West, LLC, provides consulting services to retail merchandisers in the Midwest. In 2019, they generated $720,000 in service revenue. Their total cost (stock-still and variable) per client was $ii,500 and they served 115 clients during the year. If operating expenses for the year were $302,000 what was their net income?

(Figure)Canine Couture is a specialty dog clothing boutique that sells vesture and clothing accessories for dogs. In 2019, they had gross revenue from sales totaling $86,500. Their operating expenses for this aforementioned period were $27,500. If their Price of Goods Sold (COGS) was 24% of gross revenue, what was their net operating income for the year?

(Figure)Winterfell Products manufactures electrical switches for the aerospace industry. For the year ending 2019, they reported these revenues and expenses. Employ this information to construct an income argument for the twelvemonth 2019.

(Figure)CPK & Associates is a mid-size legal firm, specializing in closings and existent manor law in the due south. In 2019, they generated $945,000 in sales acquirement. Their expenses related to this twelvemonth'south revenue are shown:

Based on the data provided for the twelvemonth, what was their net operating income?

(Figure)Flip or Flop is a retail shop selling a wide variety of sandals and beach footwear. In 2019, they had gross acquirement from sales totaling $93,200. Their operating expenses for this same period were $34,000. If their Cost of Goods Sold (COGS) was 21% of gross acquirement, what was their net operating income for the year?

(Effigy)Ballentine Manufacturing produces and sells lawnmowers through a national dealership network. They buy raw materials from a variety of suppliers, and all manufacturing and assembly piece of work is performed at their plant outside of Kansas City, Missouri. They recorded these costs for the year ending December 31, 2017. Construct an income statement for Ballentine Manufacturing to reflect their internet income for 2017.

(Figure)Tom West is a land surveyor who operates a small surveying company, performing surveys for both residential and commercial clients. He has a staff of surveyors and engineers who are employed by the firm. For the year ending December 31, 2017, he reported these income and expenses. Using this information, construct an income statement to reflect his internet income for 2017.

(Effigy)Just Beachy is a retail business organization located on the coast of Florida where information technology sells a variety of embankment apparel, T-shirts, and beach-related souvenir items. They buy all of their inventory from wholesalers and distributors. For the year ending December 31, 2017, they reported these revenues and expenses. Using this data, prepare an income statement for Just Beachy for 2017.

(Effigy)Hicks Products produces and sells patio article of furniture through a national dealership network. They purchase raw materials from a variety of suppliers and all manufacturing, and associates work is performed at their constitute outside of Cleveland, Ohio. They recorded these costs for the yr ending December 31, 2017. Construct an income statement for Hicks Products, to reverberate their net income for 2017.

(Figure)Conner & Scheer, Attorneys at Constabulary, provide a wide range of legal services for their clients. They employ several paralegal and administrative back up staff in society to provide high-quality legal services at competitive prices. For the twelvemonth catastrophe Dec 31, 2017, the business firm reported these income and expenses. Using this information, construct an income statement to reverberate the house's net income for 2017.

(Figure)Puzzles, Pranks & Games is a retail business selling children's toys and games as well as a wide option of jigsaw puzzles and accessories. They purchase their inventory from local and national wholesale suppliers. For the year ending December 31, 2017, they reported these revenues and expenses. Using this data, set an income argument for Puzzles, Pranks & Games for 2017.

(Figure)In a team of two or iii students, interview the manager/possessor of a local business. In this interview, ask the manager/owner the following questions:

- Does the business collect and use cost data to brand decisions?

- Does it have a specialist in cost estimation who works with this cost information? If not, who is responsible for the collection of cost information? Be as specific equally possible.

- What type of cost information does the concern collect and how is each type of data used?

- How important does the owner/manager believe price data is to the success of the concern?

Then, write a study to the instructor summarizing the results of the interview.

Content of the memo must include

- appointment of the interview,

- the name and title of the person interviewed,

- name and location of the business organisation,

- type of business organization (service, merchandising, manufacturing) and cursory description of the goods/services provided by the business concern, and

- responses to questions A–D.

Footnotes

- 1 Hilton. "Cost Controller: Job Description." Hosco. https://www.hosco.com/en/task/hilton-istanbul-bomonti-hotel-conference-center/cost-controller

- 2 Hilton. "Price Controller: Chore Description." Hosco. https://www.hosco.com/en/job/hilton-istanbul-bomonti-hotel-conference-eye/cost-controller

- iii John Ward. "The Services Sector: How Best to Measure It?" International Merchandise Administration. Oct. 2010. https://2016.merchandise.gov/publications/ita-newsletter/1010/services-sector-how-all-time-to-mensurate-it.asp. "U.s.a. GDP from Private Services Producing Industries." Trading Economics / U.South. Bureau of Economic Analysis. July 2018. https://tradingeconomics.com/united-states/gdp-from-services. "Employment in Services (% of Total Employment) (Modeled ILO Estimate)." International Labour Organisation, ILOSTAT database. The World Bank. Sept. 2018. https://data.worldbank.org/indicator/SL.SRV.EMPL.ZS.

Glossary

- direct materials

- materials used in the manufacturing procedure that can exist traced directly to the production

- directly labor

- labor directly related to the manufacturing of the product or the production of a service

- intangible skillful

- skillful with financial value only no concrete presence; examples include copyrights, patents, goodwill, and trademarks

- manufacturing organization

- business that uses parts, components, or raw materials to produce finished appurtenances

- manufacturing overhead

- costs incurred in the product process that are not economically feasible to mensurate as direct fabric or direct labor costs; examples include indirect cloth, indirect labor, utilities, and depreciation

- merchandising firm

- business organisation that purchases finished products and resells them to consumers

- service organization

- business that earns acquirement primarily past providing an intangible product

- tangible skilful

- physical expert that customers tin can handle and meet

Source: https://opentextbc.ca/principlesofaccountingv2openstax/chapter/distinguish-between-merchandising-manufacturing-and-service-organizations/

Posted by: morganbeet1940.blogspot.com

0 Response to "Is Alcoa Inc A Service Merchandise Or Manufacturing Business"

Post a Comment